Introduction:

Real estate investing can be a lucrative venture, offering promising returns and wealth-building opportunities. However, success in this field doesn’t come without thorough preparation and careful consideration. One of the essential steps in real estate investment is conducting due diligence. It’s the process of investigating and analyzing a property before making a purchase, ensuring informed decisions, and mitigating risks. In this article, we delve into the significance of due diligence in real estate investing and outline the key steps involved.

Understanding Due Diligence:

Due diligence is the cornerstone of prudent real estate investing. It involves a systematic examination of various aspects of a property to assess its investment potential accurately. This process allows investors to identify any potential issues or risks associated with the property and make informed decisions based on comprehensive information.

Key Steps in Due Diligence:

- Financial Analysis:

- Assess the property’s financial performance by analyzing its income, expenses, and potential for appreciation.

- Review financial documents such as rent rolls, profit and loss statements, and tax returns to verify the property’s income and expenses.

- Calculate important financial metrics such as cap rate, cash-on-cash return, and net operating income to evaluate the property’s investment potential.

- Property Inspection:

- Conduct a thorough physical inspection of the property to identify any structural issues, maintenance needs, or code violations.

- Hire qualified inspectors to assess the property’s condition, including its roof, foundation, plumbing, electrical systems, and HVAC (heating, ventilation, and air conditioning).

- Obtain a professional appraisal to determine the property’s fair market value and ensure it aligns with the purchase price.

- Legal and Title Review:

- Examine the property’s title to identify any liens, encumbrances, or legal issues that may affect ownership rights.

- Review zoning regulations, land use restrictions, and environmental assessments to ensure compliance with local laws and regulations.

- Work with legal professionals to review purchase agreements, leases, and other contractual documents to understand the rights and obligations associated with the property.

- Market Analysis:

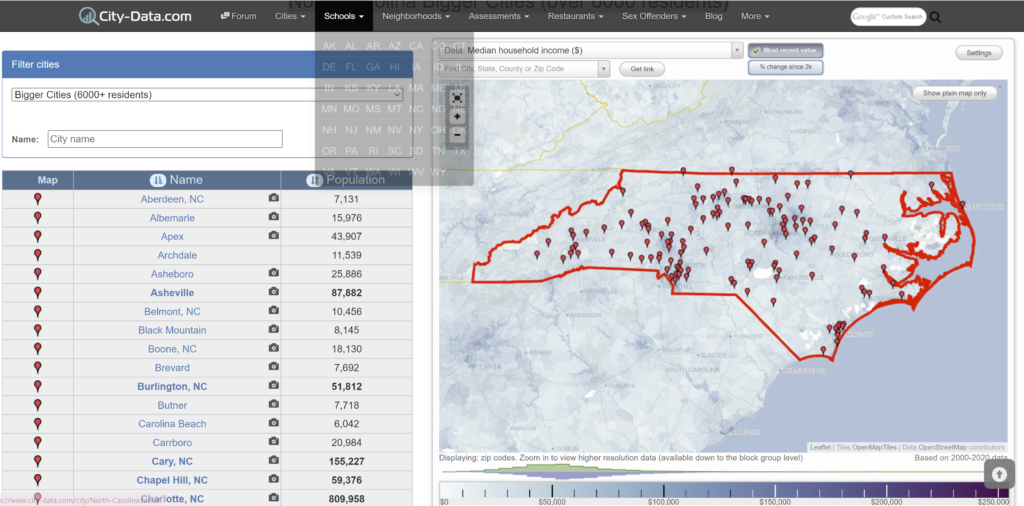

- Research the local real estate market to understand trends, demand drivers, and competitive properties.

- Analyze comparable sales data to assess the property’s value relative to similar properties in the area.

- Consider factors such as location, demographics, job growth, and economic indicators to gauge the property’s long-term viability and potential for appreciation.

- Risk Assessment:

- Identify and evaluate potential risks associated with the investment, such as market volatility, tenant turnover, or regulatory changes.

- Develop risk mitigation strategies to address identified risks and protect your investment.

- Consider factors such as insurance coverage, property management options, and contingency plans to minimize potential losses.

Conclusion:

Due diligence is a critical aspect of real estate investing that can significantly impact the success of your investment endeavors. By conducting thorough due diligence, investors can mitigate risks, maximize returns, and make informed decisions that align with their investment goals. Whether you’re a seasoned investor or new to the world of real estate, prioritizing due diligence can help you navigate the complexities of the market and achieve long-term success in your investment ventures.

The general partners at Build Vacations Equity share some best practices and helpful resources for the due diligence process in the video below…