An Ideal Strategy for Retirement Planning

Planning for retirement in 2023 is frustrating. Inflation, interest rates, and the housing market are crushing our wallets right now. While there are many forms of investments, real estate offers some clear advantages over other forms for many investors.

The stock and crypto markets are in uncertain times. They are really set up to benefit the insiders. So many of them have manipulated investors for their personal gain. They make billions, and it gets harder and harder to find a way to pay bills and prepare for retirement without becoming an insider.

Bonds seem to offer a stable consistent flow of cash. However, investors must rely on the interest paid on the bond. Bonds do not appreciate. The value of a bond is complicated to understand. Basically, if interest rates go up, bond values go down. The opposite is also true. In 2023, rising interest rates led to the failure of 4 banks, most notably Silicon Valley Bank.

Real estate used to be the principal way a busy professional could prepare for retirement. However, home prices and now interest rates are spiraling out of control.

After 20 years of investing full-time in real estate, I have shifted my focus away from entitlements, wholesaling, flipping, etc. I now work exclusively with investors to develop luxury, short-term rental communities to increase CAP rates, equity, and to protect ourselves from the determined efforts of municipalities and HOAs. This shields capital from commercial financing, eviction moratoriums, interest rate impacts on CAP rates, inflationary pressures, and changes in the MBS Spread. However, this continues to provide the unique real estate benefits of appreciation, depreciation, leverage, and cashflow.

The Four Pillars of Real Estate Investing

All real estate provides benefits that many forms of investing do not.

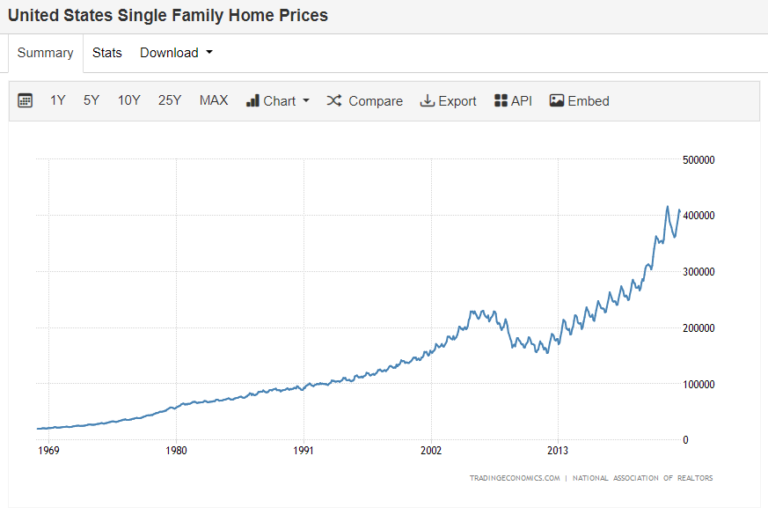

- Real estate values appreciate. Over the last 40 years, real estate around the country has appreciated at approximately 5.4%. Meanwhile, the S&P 500 has averaged around 7.5%. While on its face, this appears to indicate that the stock market may be a better place to invest. However, for the following three reasons, this doesn’t usually come to fruition.

- Real estate depreciation. Real estate investors are also able to depreciate some of the cost of their real property from their income. As an owner, you can take your acquisition costs and take a small portion to provide tax savings. When you purchase real property, a calculation is done to determine what portion of that purchase price is in the value of the building, and which portion is the value of the land. Then, you can typically reduce your income by 3.636% of the amount apportioned to the building each year for 27.5 years (39 years for commercial properties). However, over the last few years, you could deduct all or nearly all of the amount apportioned to the building. However, this rule is phasing out, and set to sunset in 2026.

- Cashflow. Perhaps the greatest advantage that real estate ownership enjoys over the stock market is cashflow in the form of rents. Your net worth or cash in the bank alone will not allow you to retire. Bills, unexpected expenses, and living too long can cause you to quickly run out of money in the bank or under the mattress. Having a consistent, reliable, steady stream of cash allows you true financial freedom. The stock-market equivalent of net rents are dividends. However, the long-term dividends in the stock market are 1.85%. Meanwhile, most real estate investments are 5% or more. This is called the CAP rate. It is calculated by dividing the annual income, after expenses, by the total cost of the property.

- Leverage. The ability to leverage real estate is the final of the four pillars of real estate investing. While there are a limited number of options to borrow money against your ownership in a stock, to do so is very risky, and often leads to a complete loss of your investment, especially for the part-time investor. On the other hand, most real estate owners have borrowed 50-97% of the cost of their real estate. This allows you to buy more property than you have investment capital. Further, borrowing against real estate is fairly inexpensive. However, it also increases the risk of the investment, and must be managed wisely.

Buying Rental Properties

Buying properties to rent is a very viable way to invest. While you can invest in commercial property, which is divided into many categories, most investors purchase homes. Homes provide an easier entry point because people will always need a place to live, financing is easier, and most people understand how to buy and rent a home.

However, you must surround yourself with the appropriate team of professionals. You will want someone to take care of the problems that arise; evictions, repairs and maintenance, inspections, etc.

Additionally, the risks of buying a rental property have gotten out of control. In Utah, a man killed his landlord when he went to discuss payment and possible eviction. Eviction moratoriums made landlords from San Francisco unable to collect rent from San Francisco to Atlanta, leaving the homeowners paying the mortgage, utilities, taxes, etc. Now, many cities around the country are pushing rent control initiatives.

REITs

A Real Estate Investment Trust (REIT) is a unique investment vehicle that allows individuals to invest in real estate properties and earn income from them without directly owning or managing the properties themselves. REITs are companies that own, operate, or finance income-producing real estate assets such as office buildings, apartment complexes, shopping centers, hotels, and more. They are often seen as a convenient way for investors to diversify their portfolios and gain exposure to the real estate market without the hassles of property management.

The benefits of investing in a REIT include:

- Income Generation: REITs are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends, which can provide a consistent stream of income.

- Liquidity and Diversification: REITs are publicly traded on stock exchanges, providing investors with the ability to easily buy and sell shares. Additionally, investing in a REIT allows for diversification across various real estate sectors, reducing the risk associated with individual property ownership.

- Professional Management: REITs are managed by experienced professionals who handle property acquisition, management, and financing, which can relieve investors of the responsibilities and headaches associated with property ownership.

The risks of investing in a REIT include:

- Interest Rate Sensitivity: The value of REIT shares are sensitive to changes in interest rates. When interest rates rise, the cost of borrowing for REITs may increase, potentially affecting their profitability and share prices.

- Property Market Risk: Economic downturns, property market bubbles, or oversupply in specific sectors can negatively impact the performance of REITs.

- Management Risk: Poor management can lead to underperformance and reduced returns for investors. Furthermore, every year, the managers charge a percentage of how much money you invested regardless of how the REIT is performing.

In conclusion, REITs offer investors an opportunity to invest in real estate with some of the benefits of owning real estate. However, they also come with a complex set of risks. As with any investment, it’s crucial for investors to thoroughly research and assess their risk tolerance before adding REITs to their portfolio.

Syndications

A real estate syndication is a partnership or collaboration among multiple investors to collectively purchase and manage a real estate investment property. In a typical syndication, there are two primary roles: the syndicator (also known as the sponsor) and the passive investors. The syndicator is responsible for finding, acquiring, managing, and potentially selling the property, while passive investors provide the capital needed for the investment. The syndicator usually earns a portion of the profits for their expertise and effort. This provides a distinct advantage over a REIT, as you are paying a portion of the profits, instead of your hard-earned capital.

Benefits of investing in a real estate syndication include:

- Access to Expertise: Real estate syndications allow passive investors to leverage the expertise and experience of the syndicator. This can be especially valuable for individuals who may not have the knowledge or time to manage real estate investments themselves.

- Diversification: Syndications offer investors the opportunity to diversify their real estate portfolios by investing in different types of properties, such as multifamily apartments, office buildings, or industrial spaces, without having to buy an entire property on their own.

- Potential for Higher Returns: Syndications often target properties with the potential for higher returns compared to more conservative real estate investments like REITs or single-family rentals. This can lead to attractive income and appreciation potential.

Risks of investing in a real estate syndication include:

- Lack of Control: Passive investors have limited control over the day-to-day management decisions of the property, as the syndicator typically holds the decision-making authority.

- Illiquidity: Real estate investments are typically illiquid, and syndications are no exception. Investors may have limited opportunities to exit their investments before the property is sold, potentially tying up their capital for several years.

- Market and Property Risk: If the market or the property doesn’t perform as expected, investors could experience lower returns or even losses.

If you are busy or inexperienced, purchasing real estate can be difficult and time consuming. However, the REIT may allow individuals to invest in income-producing real estate assets like office buildings, shopping centers, and hotels without directly owning or managing them. Investors should carefully assess their risk tolerance and conduct due diligence before adding REITs to their investment portfolio. The same is also true of syndications.

However, real estate investing is the better tool for regular investors to prepare for retirement to provide never-ending cashflow, increasing net worth, tax benefits, and an overall balance to your portfolio.